SaaS & Services

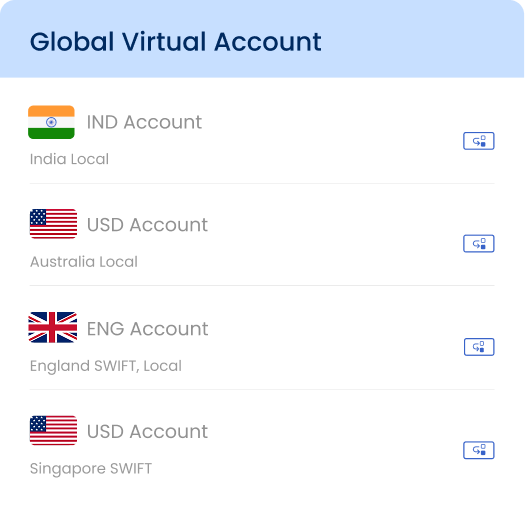

Accept multi-currency collections from global customers with seamless INR settlement. Built-in documentation, compliance, and regulatory reporting included.

Accept payments from 190+ countries. Settle within 24 Hours.

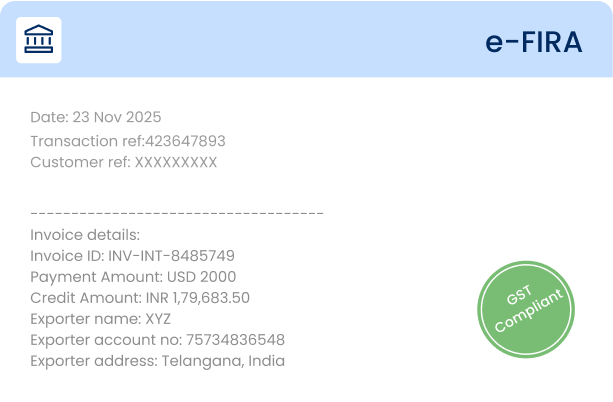

e-FIRA automatically generated and emailed for each successful transaction.

Track transactions in real-time through unified dashboard.

No surprises

No surprises No hidden charges

No hidden chargesFor payments up to

You pay

per transaction

For payments between

You pay

per transaction

For payments

You pay

per transaction

Zero Forex Markup

Zero Forex Markup  No Hidden Charges

No Hidden Charges  Faster Payments

Faster PaymentsYour payment method

Global Bank Account

Global Bank AccountInvoice Amount

Invoice Amount

*currency / INR on Jan 27, 2026, 12:39 IST

Modern infrastructure designed for fast, compliant global transactions.

| Feature | Traditional Methods | Toucan CrossStream |

|---|---|---|

| Settlement Time | 5-7 business days | T+1, T+2 |

| Transaction Fees | 3-5% hidden charges | Lower transaction rates |

| FX Rates | Opaque markup (1-3%) | Low interbank rates, no markup |

| FIRA Documentation | Manual process, days wait | Auto-generated instant e-FIRA |

| Onboarding | Weeks of paperwork | Digital KYC, live in 24 hours |

Toucan enables businesses across industries to accept and settle global payments seamlessly, enter new markets faster, and grow revenue powered by a secure, compliant, and scalable cross-border payment infrastructure.

Accept multi-currency collections from global customers with seamless INR settlement. Built-in documentation, compliance, and regulatory reporting included.

Manage cross-border collections and seller payouts at scale with split settlements. Automated reconciliation and PA-CB compliant workflows from one platform.

Collect international payments faster and receive compliant INR credits directly to your bank. Documentation and reporting handled end-to-end.

Everything you need to manage cross-border payments end to end

Confirm your mobile number to begin account creation.

Choose your account type along with supported currencies.

Complete PAN and Aadhaar verification securely through our system.

Your virtual accounts are set up and ready to use.

Expand globally, settle effortlessly, and manage every payment from one platform.

Get Started with ToucanYou’ll need basic business details, KYC documents, and a valid bank account to start sending or receiving payments internationally.

Fees depend on the transaction amount, destination country, and payment method. Transparent rates are provided upfront before you confirm a transfer.

Exchange rates are based on real-time market rates, often with a small margin included by the payment provider.

Yes, you can track every transaction in real time through your account dashboard until it reaches the recipient.

Typically, identity proof, business registration documents, bank account details, and KYC-compliant forms are needed.

Transactions can usually be canceled or reversed only before they are processed. Once completed, cross-border payments are generally irreversible.

Yes. Toucan’s digital banking app allows full customization to match your brand identity and functionality needs, both during and after development.

SLA, dispute handling, settlement guarantees, and liability terms are negotiated per merchant agreement and customized for each enterprise profile.

Payment tokenization, data localization, and PCI-DSS compliance are enforced end-to-end. Token vaults and payment data are stored within India, with no cross-border transfers without consent or central bank/regulatory approval.